Blog tagged as A Long Position

This is options expiration week, let's take a look at what has happened historically on Monday of options expiration week.

This unique day has often pushed higher into the close, I'll let you decide if it is signal or noise...

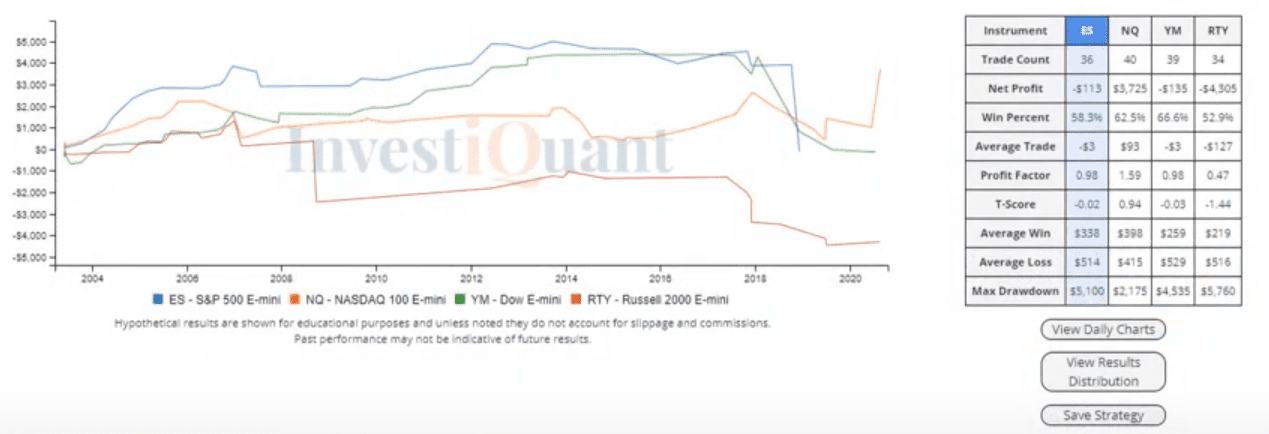

The markets were weak yesterday, let's use Pivot Points to describe it and see what it has led to the following session.

The markets are testing below yesterday's low as we approach the close, let's see what that has led to in a similar environment.

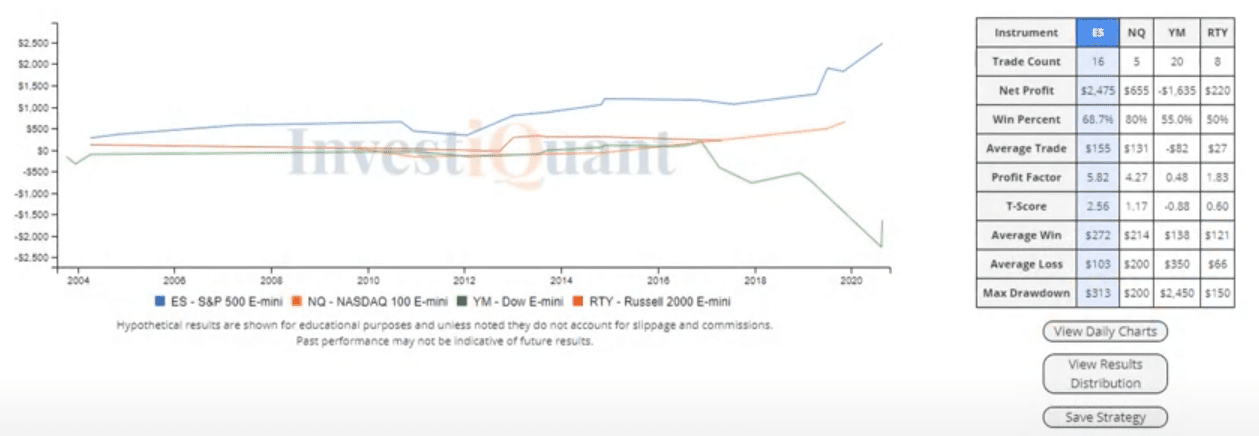

Yesterday closed at a 52 week high in some of the indices, here are some stats based on that close.

This recent seasonality bias hasn't held up well into the close.

I'm not sure why, but this seasonality pattern has been quite bullish recently.

We are potentially forming a unique price pattern that we haven't seen since March, here is what it has led to historically.

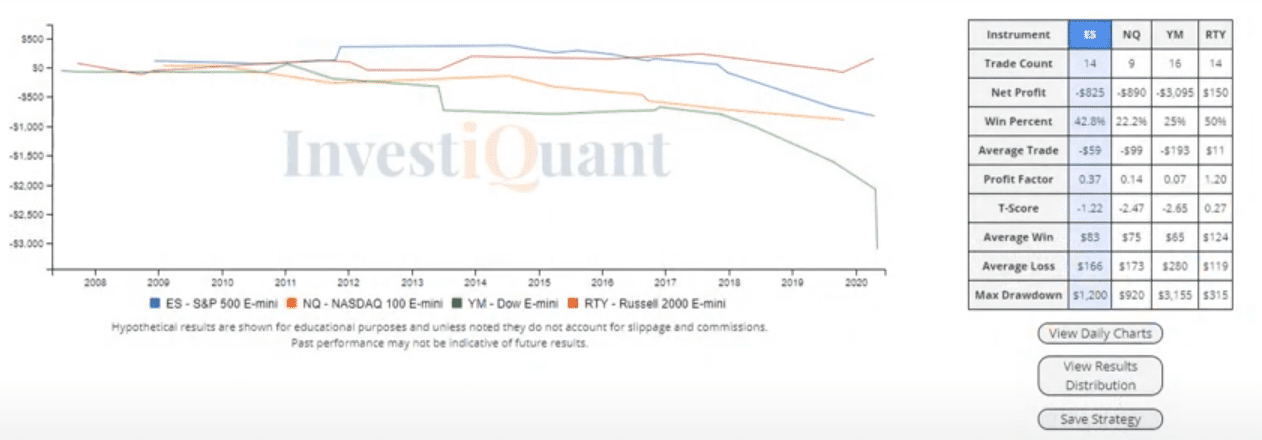

The markets gapped up huge yesterday then sold off, let's see what that pattern has led to historically.

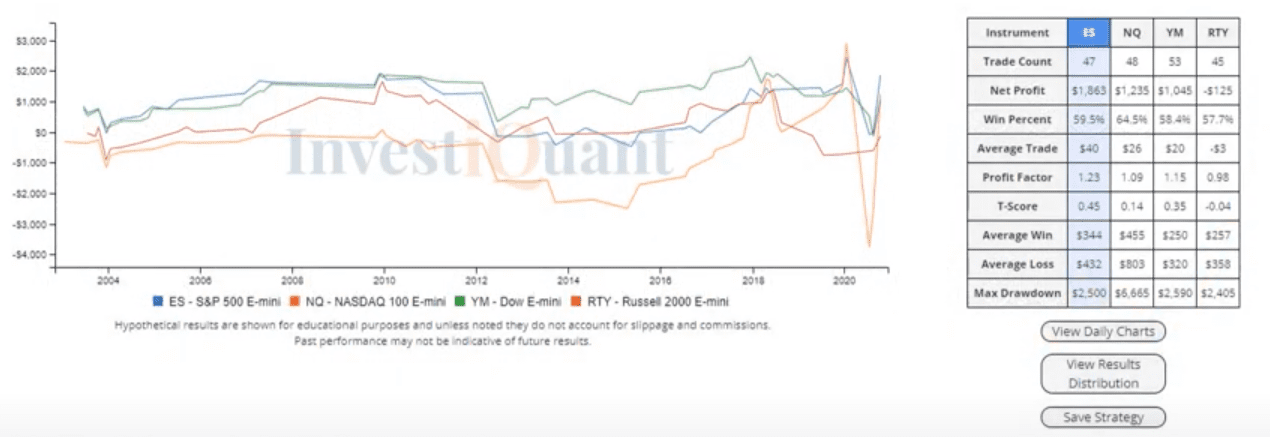

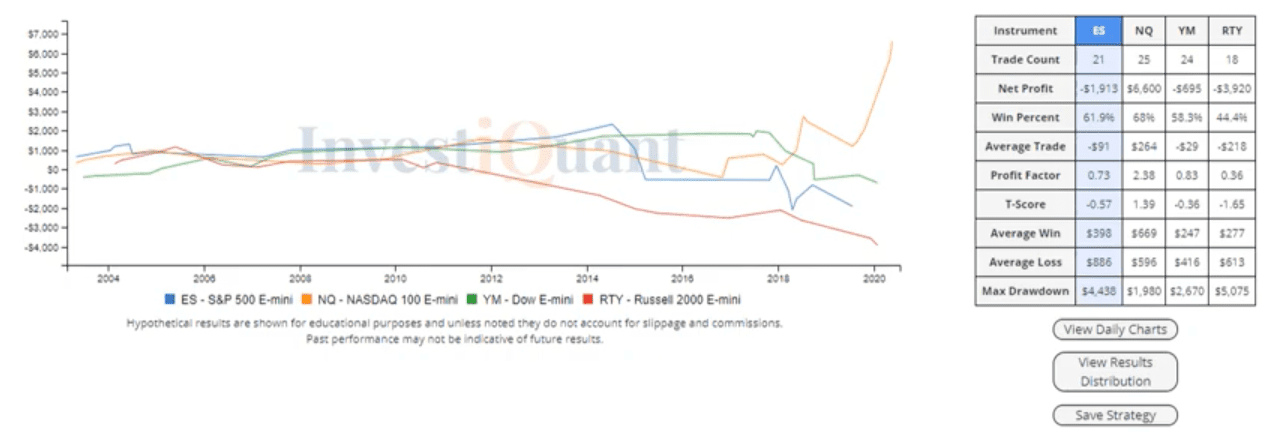

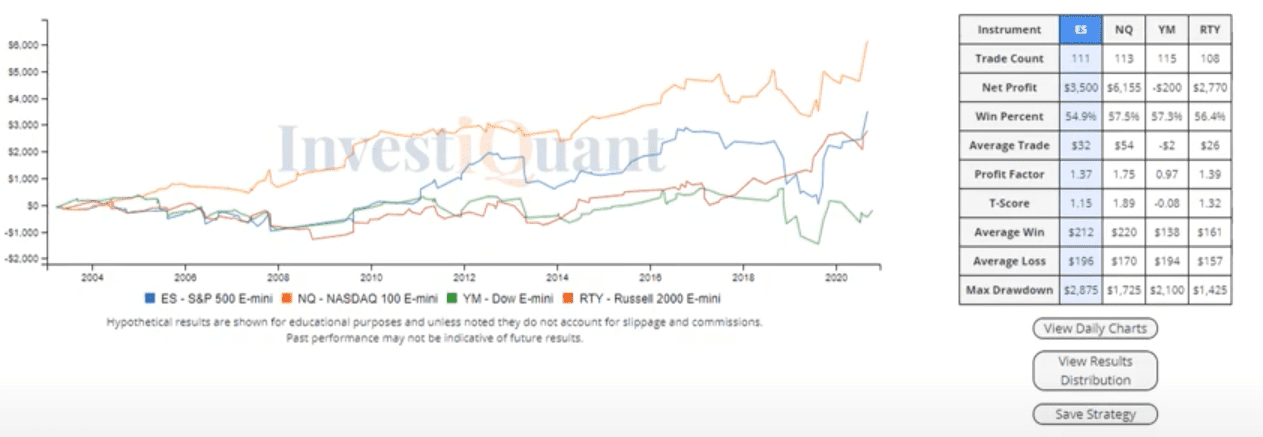

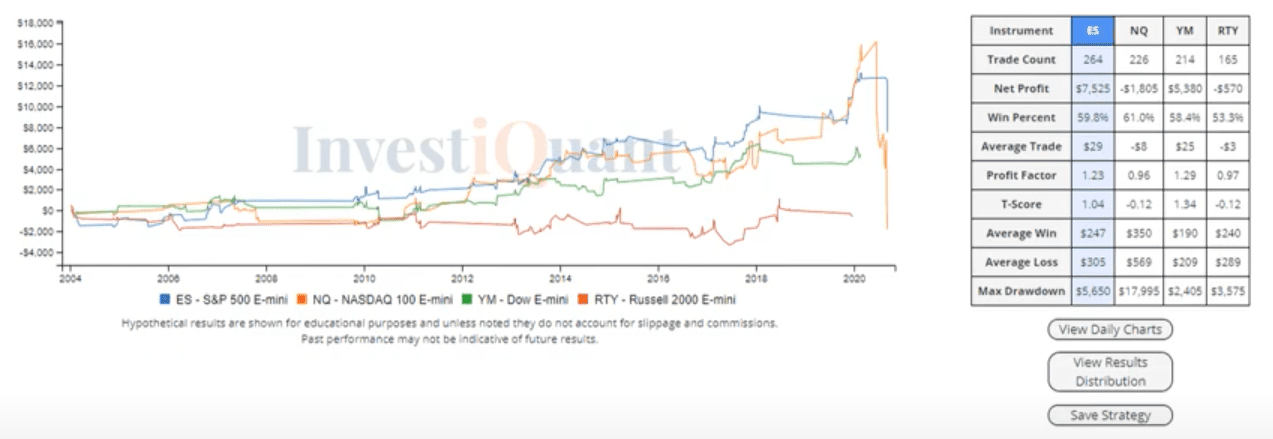

Day - Monday

Opening Gap Direction - Up

Market Status - Large morning up gap followed by sideways day

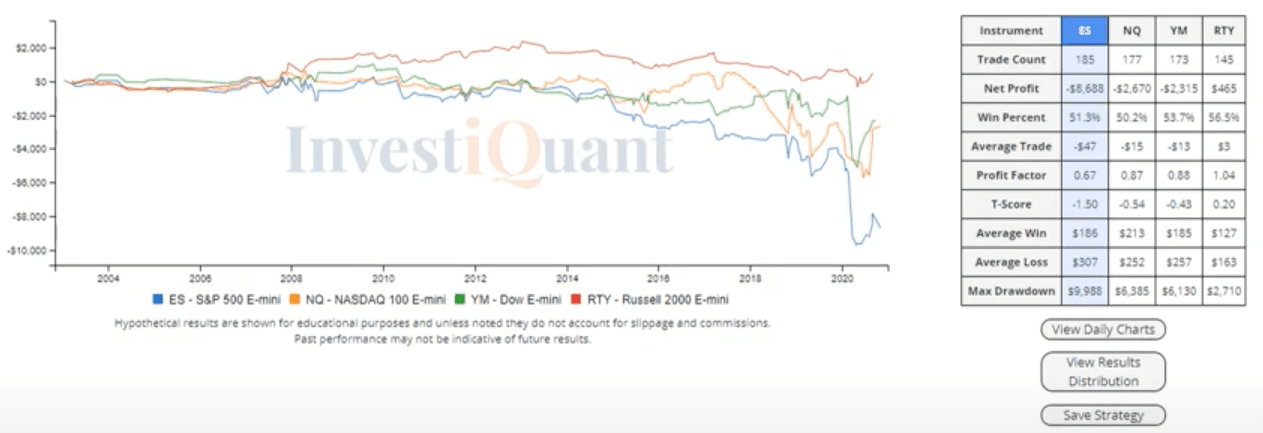

Instrument - ES, NQ, RTY, YM

Trading SetUp - Long

Market Trend - Weak Bull

Trade Type - Time Based Entry

Entry - 3:00 pm ET

Exit - 4:15 pm ET (Market Close)

Note: Most tests/studies are done going long...