Ways to Reduce Risk When Autotrading: A Guide

The Importance of Portfolio Diversification

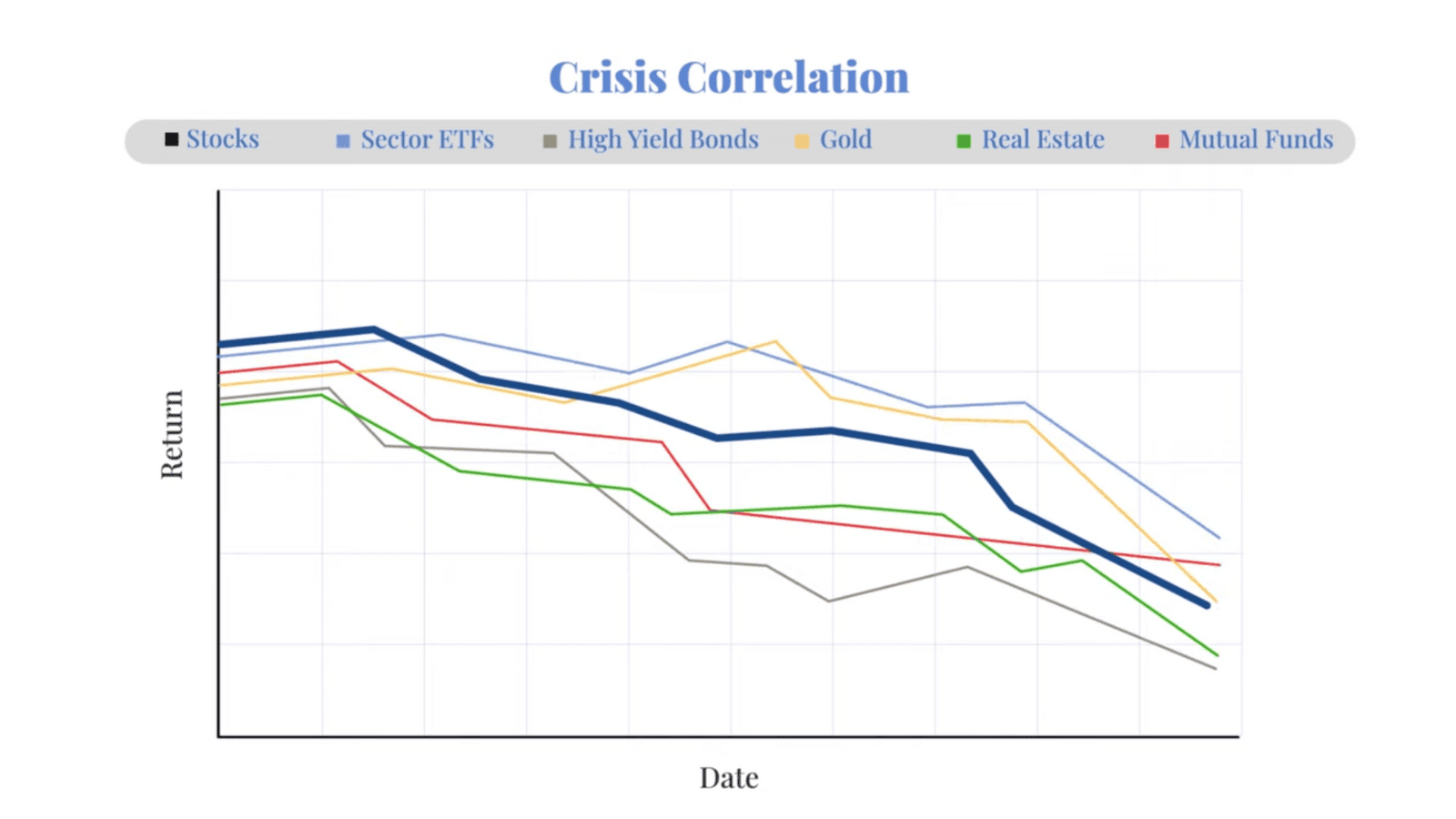

As economist and Nobel laureate Harry Markowitz famously said, "Diversification is the only free lunch" in investing. However, every financial crisis of the past 40 years has proven that traditional portfolio diversification fails investors when they need it most: during volatile markets and times of turmoil.

Remember 2000, 2008, 2020, 2022?

Your diversification let you down. Why? Because of a little-known market phenomenon called "crisis correlation."

The solution lies in short-term, fully automated trading strategies that can trade your account for you—in both directions—and capitalize on market volatility that is so damaging to investors’ portfolios. How? By leveraging statistically-based, quantified strategies guided by InvestiQuant’s advanced machine learning and artificial intelligence (AI) technology. Whether your portfolio consists of equity index investments, stock ETFs, mutual funds, e-mini futures, or commodities like bonds, interest rates, gold, oil, and currencies, autotrading can provide powerful, value-added diversification to improve the performance and stability of your investment portfolio using adaptive, short-duration strategies.

Best of all, data-driven, real-time algorithmic strategies can systematically trade your account right alongside IQ’s own accounts, so clients earn the same results as the iQ employees and shareholders. Unlike a hedge fund, you maintain visibility, control, and access to your funds 24/7, 365 days a year.

Do Your Due Diligence

An autotrading provider who doesn't trade the same strategies they offer to clients should raise a massive red flag. Transparency, both upfront and ongoing, is absolutely crucial. Publishing actual live trading results of clients' accounts, and if applicable, realistic simulated historical performance data, enables investors to comprehensively assess the risks of an autotrading program they're considering.

Risk is also embedded in the design and diversification of an autotrading program's strategies. Providers should be open and able to explain in detail how they manage risk. This openness is key in empowering investors to make well-informed decisions and minimize the risk of investing hard-earned capital in a trading program with little chance of delivering positive returns.

Unlike many 3rd party strategy developers, InvestiQuant doesn’t hide behind hypothetical results and disclaimers, which can be incredibly misleading and dangerous. Reputable autotrading providers share every program's live trading results from inception, usually along with realistic simulated returns for the prior few years. This paints a more complete picture of how a strategy would have performed in various market conditions.

Relying solely on hypothetical results without live trading confirmation is very risky, as simulated results are often over-optimized and rarely account fully for real-world execution slippage. If a program trades frequently, live results may vary by 50% or more compared to simulations. When evaluating signal developers, buyer beware!

Operational risk management is paramount in autotrading. A trustworthy autotrading service must have a robust operational framework backed by a capable, diverse team and strong contingency plans. (Watch out for one-man and two-man developer teams!) Advanced hosting solutions like the cloud indicate a proactive approach to minimizing technical and operational disruptions. This ensures that trading strategies are executed continuously and effectively.

Understand the Risk Management Process

Some autotrading providers, like InvestiQuant, focus on intraday timeframes to mitigate the risks and constraints of buy-and-hold investing. Intraday trading solutions allow investors to avoid the dangers of overnight markets while taking advantage of volatility during the trading day itself.

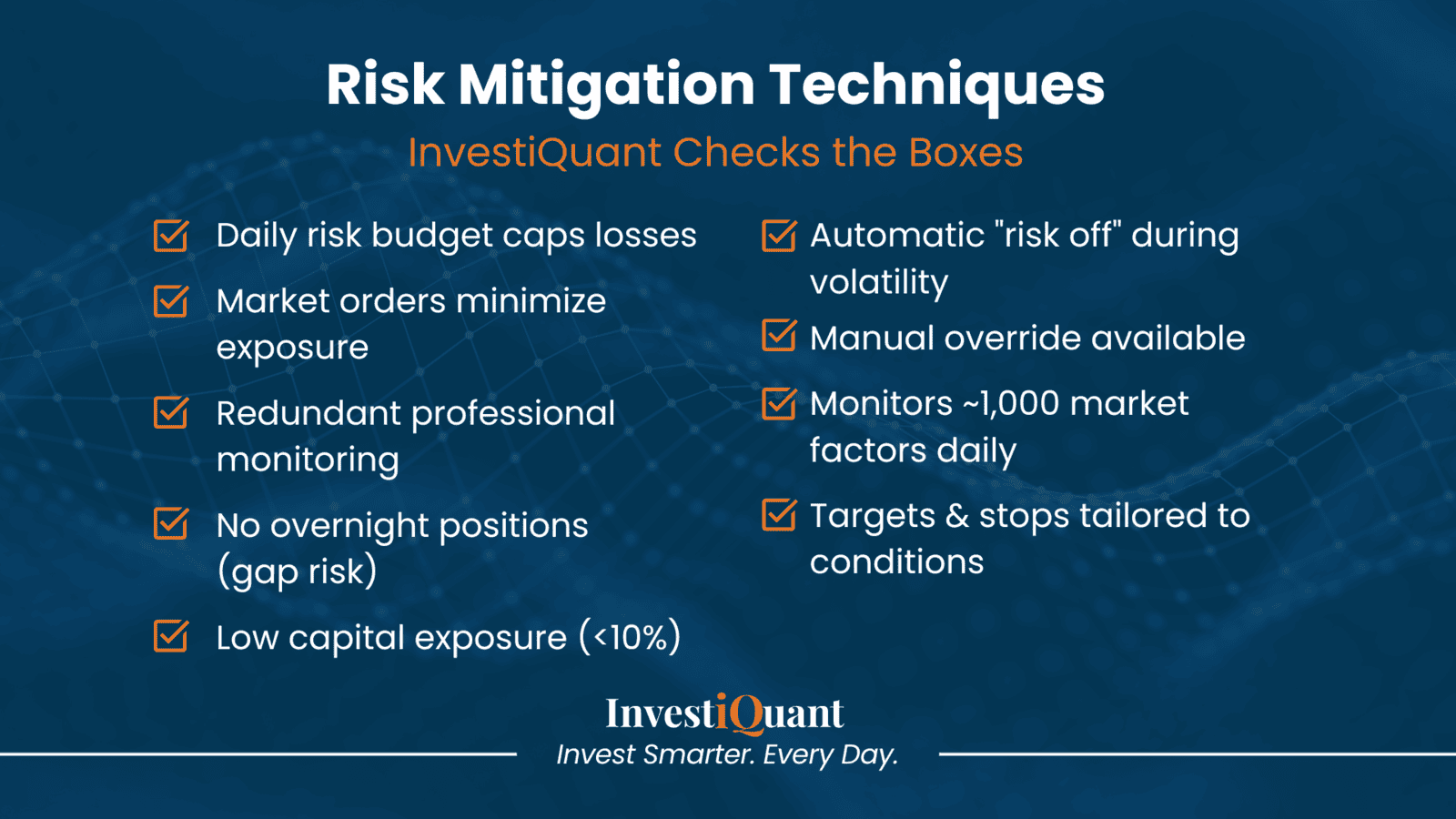

InvestiQuant utilizes an abundance of risk-mitigating techniques, like:

Setting a daily risk budget for each program to cap losses

Using market orders to exit positions immediately, minimizing exposure

Redundant monitoring by professionals to avoid errors

No overnight positions held to avoid gap risk

Keeping capital exposure under 10% vs. traditional stock investing

Automatic "risk off" during extreme volatility

Manual override available if deemed necessary

Constant monitoring of nearly 1,000 market factors daily

Targets and stops automatically tailored to current conditions

Diversify With Multiple Strategies

When autotrading, diversification is extremely helpful as no single strategy works all the time. Markets change, and even the most adaptive strategies may struggle in a given year. Investing in a large, well-diversified autotrading program suited to your risk tolerance and budget, or combining multiple programs, can lead to smoother, more consistent returns over time.

Whether you're a conservative investor seeking to preserve your capital or an aggressive trader looking to maximize returns, InvestiQuant has the expertise and flexibility to help you build a diversified autotrading portfolio that works for you. Our commitment to transparency, coupled with our track record of success, means you can invest with confidence, knowing that your wealth is in capable hands.

Ready to learn more? View the historical performance of iQ’s autotrading programs and build your own custom portfolio using the iQ Portfolio Builder.