Today is a special options expiration day, let's look at what has happened on this day historically.

Key Event: Quad Witching Options Expiration Day

Event Details: Quadruple witching options expiration refers to a date on which stock index futures, stock index options, stock options, and single stock futures expire simultaneously. While stock options contracts and index options expire on the third Friday of every month, all four asset classes expire simultaneously on the third Friday of March, June, September, and December. Once an options or futures contract passes its expiration date, the contract is invalid. Therefore, traders must decide what to do with their options by this last trading day.

Day - Friday

Opening Gap Direction - n/a

Market Status - Quadruple Witching Day - OPEX

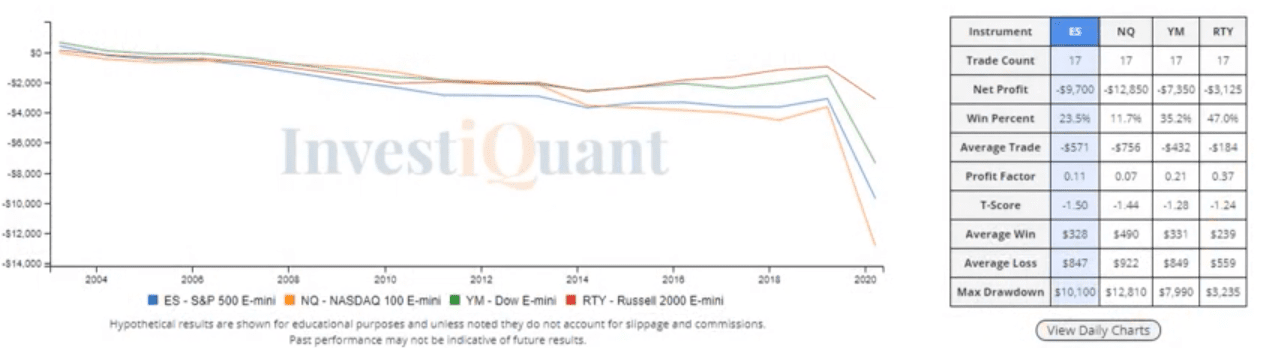

Instrument - ES, NQ, RTY, YM

Trading SetUp - Long

Market Trend - Bull

Trade Type - Intraday Entry

Entry - 9:30 am ET (Market Open)

Exit - 4:15 pm ET (Market Close)

Note: Most tests/studies here are done going long using Future Indices. This is done for several reasons; so you can easily compare different studies/tests, and because of the high correlation of these Indices to other instruments. The Daily IQ is typically an End of Day analysis without stops/targets. You can use Discover to test/study other potential trades with numerous stop/target values. You can make comments below.

Click the "Sign Up" button below to receive the DailyiQ messages in your email inbox immediately as they are released.