In this month’s update…

- March 2025 Performance

- A Note to Our Clients

- Coming Soon!

- Thank You For Helping Us Help Our Fallen Military and First Responder Families

On the heels of the S&P 500 (SPX) notching new all-time highs (6151) in late Feb, the United States announced sweeping tariffs. By March 13th, it had declined to 5530— a stunning 10.1% drop and a reversal to below the 10, 50 and 200 SMA in just 3 weeks. It was the 5th fastest “correction” of this magnitude since World War II. By the end of the month, stocks had endured their worst performance since 2022 with the S&P 500 (SPX) finishing down -5.8%.

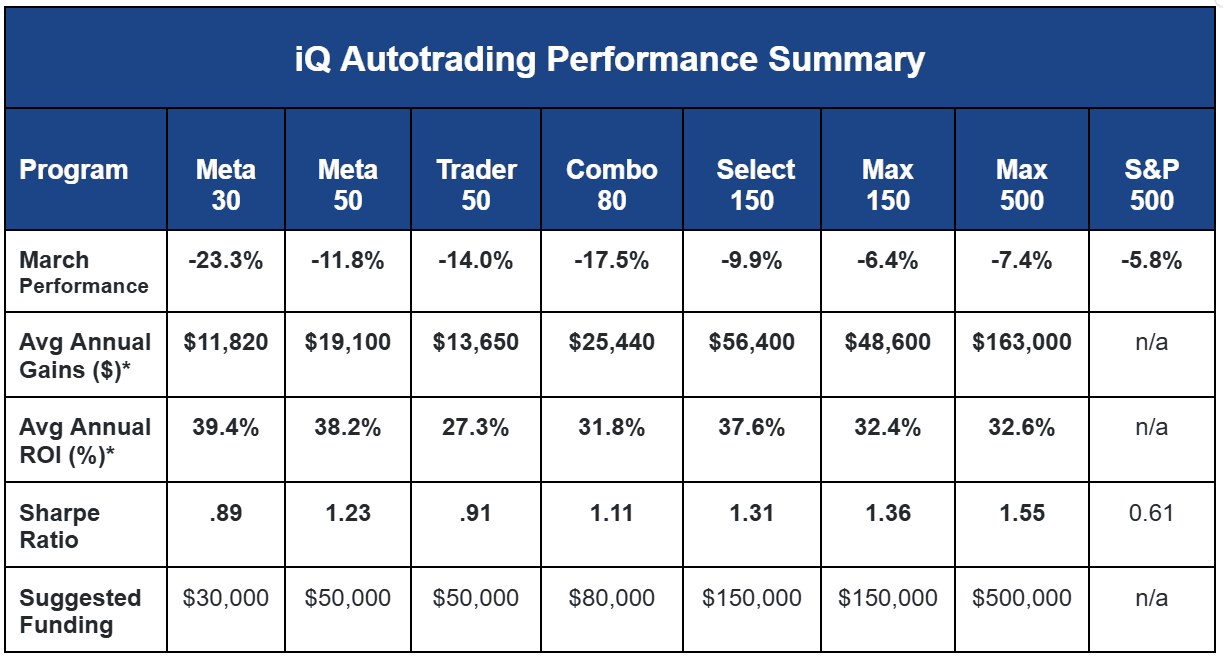

Despite the general affinity our autotrading programs have for volatility, the algos struggled and finished down across the board, with most suffering their largest losing month since just before the bear market of 2022. However, there are silver linings as three of our programs have (modestly) outperformed the S&P 500 year-to-date: Meta 30, Max 150, and Max 500.

* Returns based on live and simulated results since 2018, using suggested funding. Does not include license fees – which start at $3,900 — see pricing below. View full performance & disclaimers here. Source for S&P 500 Sharpe ratio is Morningstar based on past 5 years as of Dec, 2024.

Past performance may not be indicative of future results.

A Note to Clients

First, congratulations to those who initiated or increased their autotrading allocations in March. Though challenging psychologically, buying into a drawdown is one of the best ways to take advantage of our algorithms' adaptive nature. I believe history will prove your timing to be fortuitous. Well done.

To our many clients who continue to allocate a portion of their portfolios to our programs for unique diversification, thank you for making us part of your long-term plan. We’re committed to rewarding your trust and patience.

For newer investors who joined in the past year and are experiencing this drawdown without the cushion of prior gains, we know this is especially difficult. We’re feeling it too—I increased my own exposure last year, as did a close friend, a neighbor, a club member, and even my mother. This isn’t just business—it’s personal. I truly empathize with the discomfort that comes with drawdowns, but I remain confident that those who stay the course will be positioned for the kind of recovery we’ve seen after past declines.

Lastly, check your email for an exclusive autotrading “question and answer” discussion with me. I shared empirical data that explains what’s caused the current drawdown, why it’s within expectations, and the probabilities that support why I remain confident, and more.

If you are not a client, email [email protected] for answers to the above questions and any others you have.

Coming Soon

Over the past year, we’ve been evaluating and trading a new autotrading program that takes a fresh approach to the markets. Unlike our existing programs, this new program leverages a broader range of markets and incorporates multiple timeframes, allowing positions to be held for several days, or longer.

The program has demonstrated impressive returns and, most importantly, offers performance that is uncorrelated with our other strategies (as evidenced by its positive gains in live trading), providing an exciting opportunity for diversification. We’re enthused about this program and are preparing to make it publicly available in the near future. Stay tuned for more updates.

Folds of Honor Results

This Spring we set out to raise money for a charity that helps pay for the education of children and spouses of fallen military service members and first responders called Folds of Honor. With the help of our new and existing clients who initiated or added to their autotrading allocations during the promotional period, we were able to write a $12,000 check to this life-changing charity. Learn more here. Thank you for your support!iQ Autotrading programs are licensed annually and fees equate to a small percentage of each program’s Average Annual ROI. Prices start at $3,900. Request details and payment options here. Discounts are available for veterans of the military and law enforcement. Larger programs and volume discounts are available for family offices and investors seeking to invest with greater amounts. Email [email protected] for details.

Want To Learn More?

Check out Answers to Common Autotrading Questions here. If you would like to request a 1-1 call/meeting with Matt, email [email protected]. You can also schedule a Zoom call/meeting with me here.

Thought of the Month

"You may have to fight a battle more than once to win it."

– Margaret Thatcher

Scott Andrews

InvestiQuant.com

CEO & Co-Founder