Blog categorized as DailyiQ

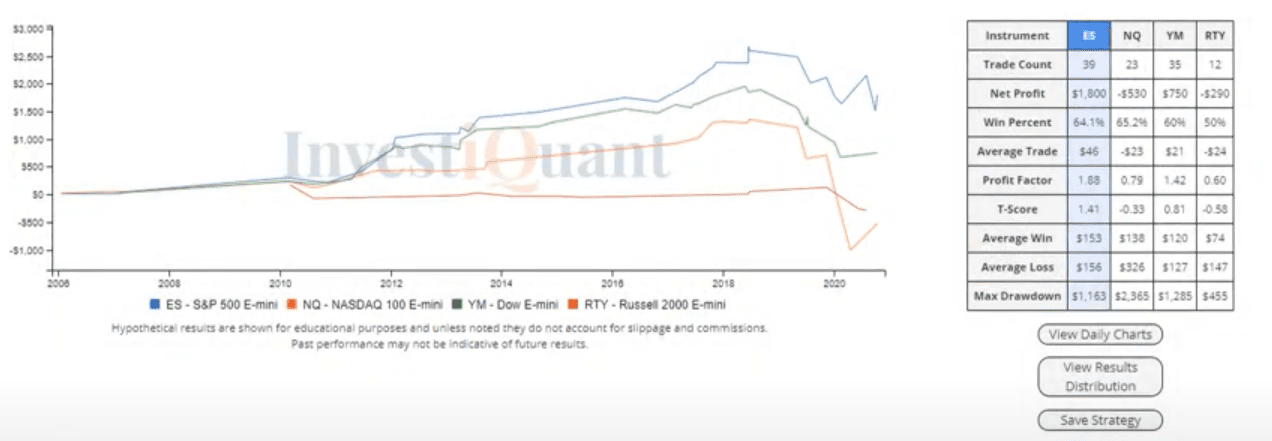

This pattern into the close the day before options expiration has often favored the long side, check it out.

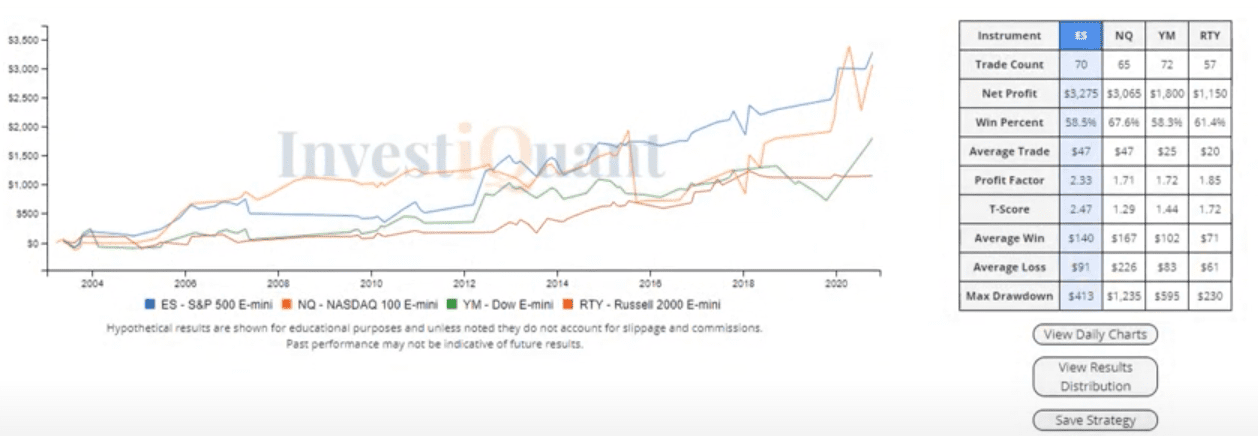

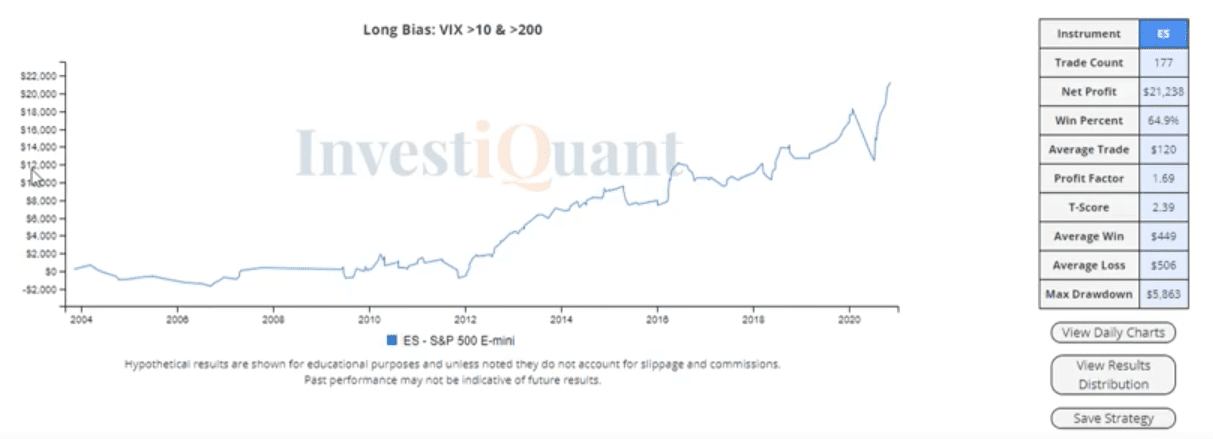

We are approaching options expiration day, here is a quick study looking at what has happened the day before opex.

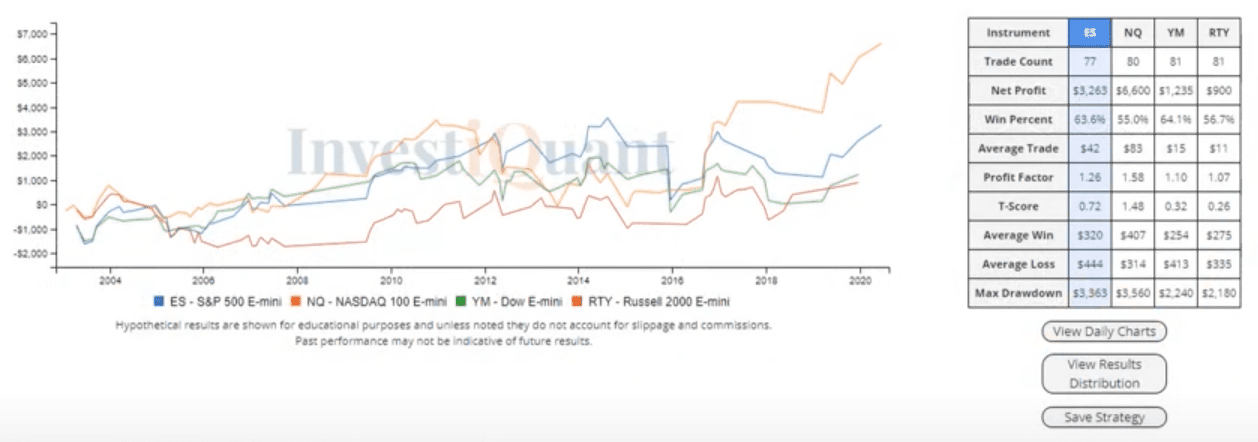

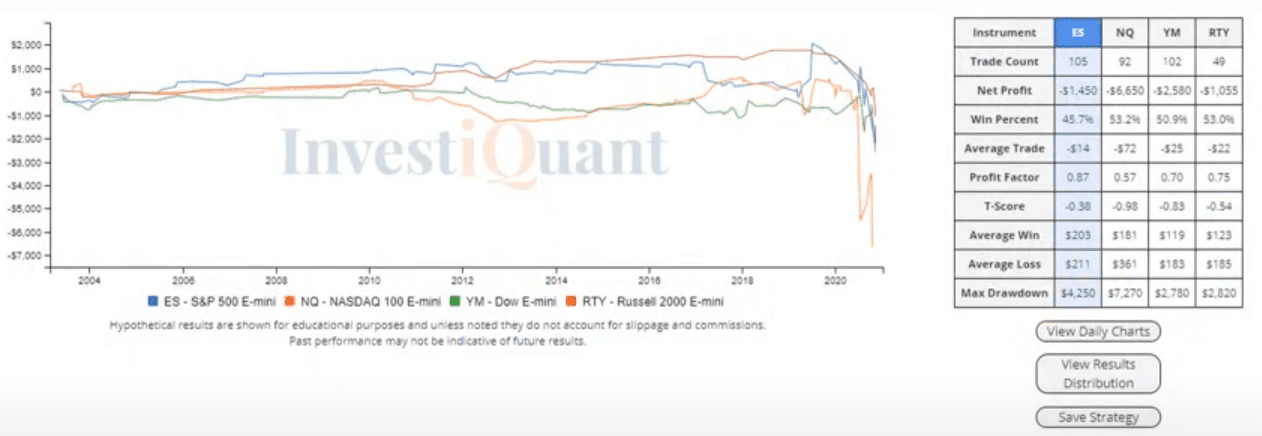

The markets have seen choppy action and light ranges today, let's see what that has led to as we approach the close.

This event-based pattern from our bias alerts has favored the longs in the Crude Oil market.

The markets found a bottom early and are marching back towards yesterday's close, let's see what that has led to as we approach the end of the session.

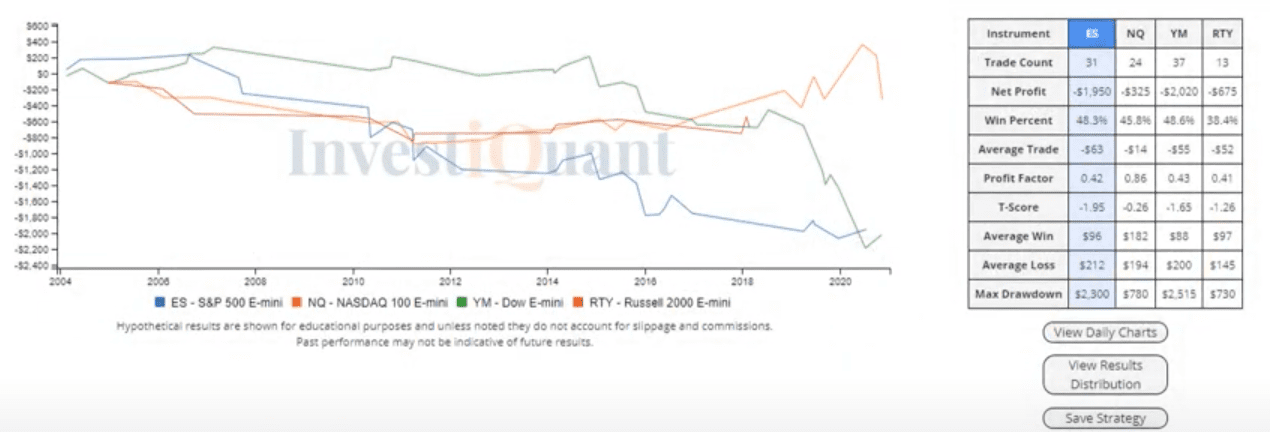

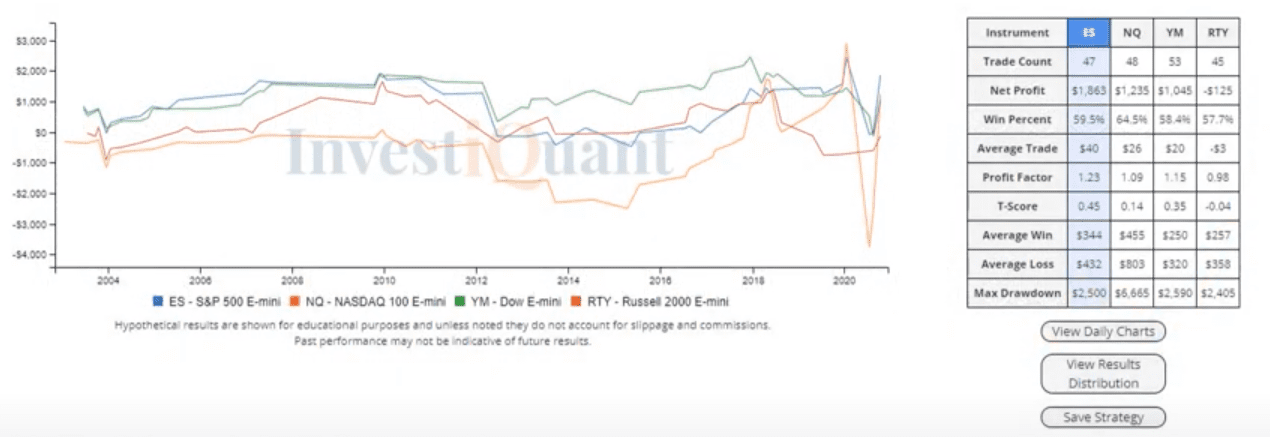

This bias alert will be in play today if we open below yesterday's low, it has often favored the bulls.

The markets gapped up this morning and are trying to hold above Friday's High, let's see what that pattern has led to as we approach the close.

This is options expiration week, let's take a look at what has happened historically on Monday of options expiration week.

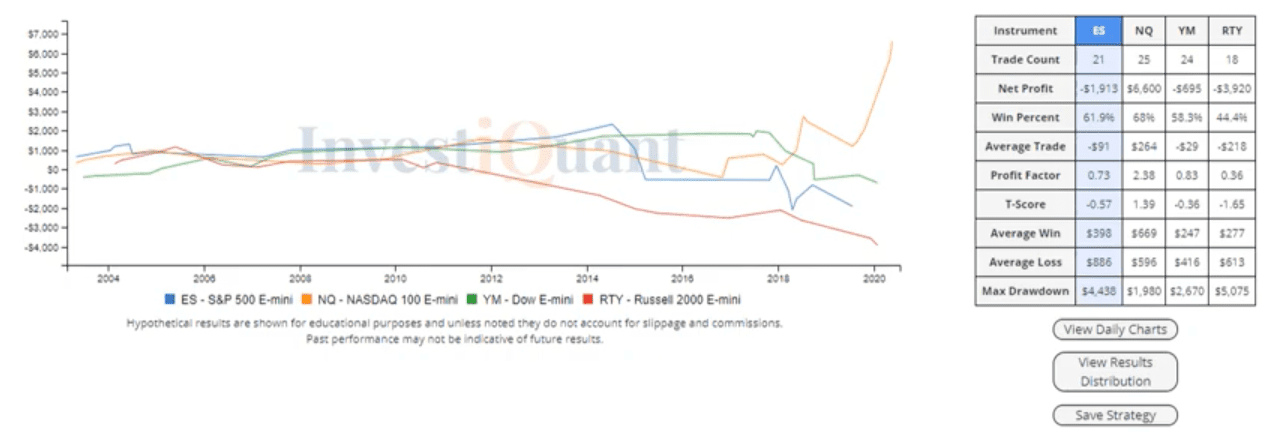

This unique day has often pushed higher into the close, I'll let you decide if it is signal or noise...

The markets were weak yesterday, let's use Pivot Points to describe it and see what it has led to the following session.